Withholding Tax Rates Tanzania

Withholding taxes on business and capital incomes such as dividends interest and royalties are also applicable at the rates ranging between 10 to 20. However the total income of a non-resident individual is charged at the rate of 20.

Https Www2 Deloitte Com Content Dam Deloitte Tz Documents Tax Tanzania 20alert 20 20finance 20act 202020 20updates Pdf

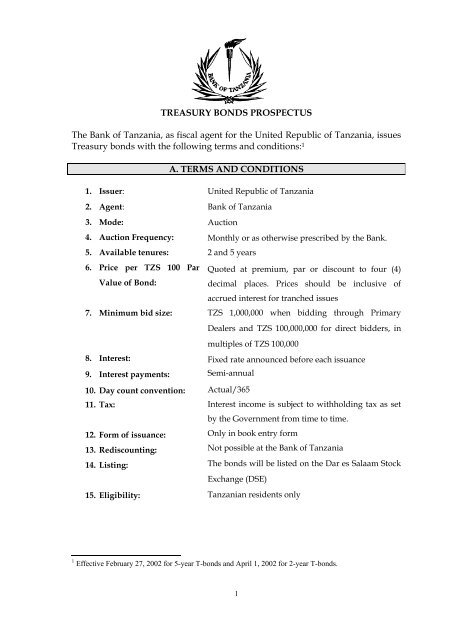

Withholding from Investment Returns.

Withholding tax rates tanzania. The disposal of an investment with a Tanzanian source is subject to tax at a rate of 10 if disposed by a resident and 30 if disposed by a non-resident. Engaged in small scale mining operations to pay withholding tax at a rate of 06 percent in relation to employment income of an employee to that individual. Rate for Non Resident.

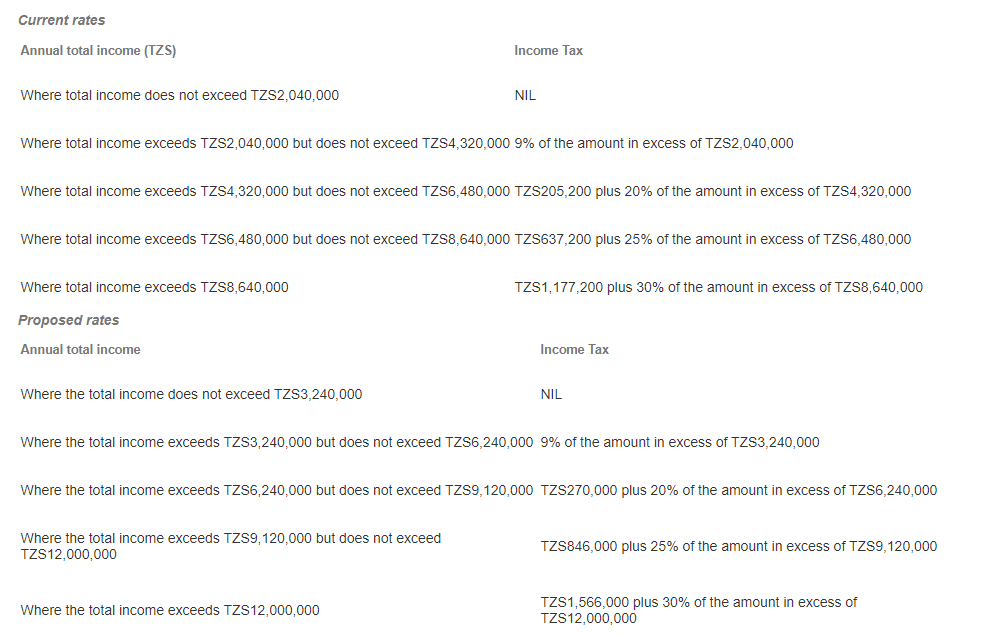

Income tax is charged at a rate of 30 on income of a resident corporation and of a permanent establishment PE of a non-resident corporation or 5 of turnover for technical and management service providers to mining oil and gas entities deducted by way of WHT. A Private residence - Gains of Tshs. Income Tax Table 20212022.

The amendments further propose timing of the withholding tax on the employment income to be the time of selling minerals and payment of royalty. Withholding tax rates on payments made by resident persons to resident and non-resident companies. Basis Tanzanian residents are taxed on their worldwide income.

19 rows Double tax treaty DTT rates. WHT is levied at varying rates 3 to 25 on a range of payments to residents and non-residents. Company Y would pay a net amount of USD 850 after withholding USD 150 tax at 15.

Where the income from investment represents a final withholding payment the tax rate applicable is the relevant withholding tax WHT rate. Non-resident WHT is a final tax. Income Tax Payable by Instalment 88.

Income Tax Payable by Instalment 88. 11 Income Tax 2004 83. Resident WHT is either a final tax or creditable against CIT.

If we assume Company Xs profit before tax is 20 of revenue this would mean a profit of USD 200. If the recipient is an individual who is not in business the tax is final otherwise it is non-final. Credit for Non-Final Withholding Tax.

For non-resident employees of a resident employer the income is subject to withholding tax at the rate of 15. The tax rates for selected tax sources in Tanzania are as shown on the following Tables below. Total income TZS Rate payable up to 2 040 000 0 2 040 001 4 320 000 9 4 320 001 6 480 000 20 6 480 001 8 640 000 25 over 8 640 000 30 Residents Non-residents Employment payments 0 30 15 Directors fees other than full time service 15 15.

Withholding from Service Fees. Statements and Payments of Tax Withheld or Treated as Withheld. The normal rate of WHT on dividends is 10.

Withholding income tax on sale of minerals Small miners Other withholding payments 5 15 NA 15 30 Capital Gains on Disposal of Investment Asset Persons asset Entity and Individual 10 20 Exemption on disposal of Investment assets. Subdivision B - Procedure Applicable to Withholding 84. 70 Withholding tax obligations The law requires a resident person who makes payment to another resident or non- resident to withhold a tax at the rates specified under paragraph 4c of the First schedule of the Income Tax Act.

Income Tax Table 20172018. Income Tax Table 20182019. Withholding from Service Fees.

Rates of Withholding Tax Resident Non-resident Dividend 5 10 - from DSE listed company 5 5 - otherwise 10 10 Interest 10 10 Rent - land and buildings 10 Semi-finished goods 10 10 10 0 10 Royalty 15 15 Natural resource payment 15 15. Where a dividend is paid by a resident corporation to another resident corporation holding 25 or more of shares and voting rights in the corporation paying the dividend the WHT rate is 5. 15 rows Withholding Tax rates.

Non-residents are taxable on income with a source in Tanzania. 15 million or less b Agricultural land - Market value of less than 10 million. The domestic WHT rate applies unless the DTT rate is lower.

Statements and Payments of Tax Withheld or Treated as Withheld. Credit for Non-Final Withholding Tax. Procedure Applicable to Withholding 84.

If you make a rental payment for any type of asset to a non-resident you must withhold tax at. If you make rental payment for land or buildings to a resident you must withhold tax at a rate of 10. Tanzania Revenue Authority website.

For example Company X is a non-resident that performs services from a place abroad to a beneficiary in Tanzania Company Y with a value of say USD 1000.

Tanzania Finance Act 2019 Activpayroll

Tanzania S Parliament Passes Finance Bill 2020 Ey Global

Corporate Taxes Top Up Tanzania S Treasury Extractive Industries Transparency Initiative

Tanzania Revenue Authority Ppt Download

Tanzania Business Expense Deduction Activpayroll

2019 2020 Tanzania Budget Speech Summary By Bcassian Issuu

Pdf Do Tanzanian Companies Practice Pecking Order Theory Agency Cost Theory Or Trade Off Theory An Empirical Study In Tanzanian Listed Companies

Understanding And Calculating Paye In Tanzania Seifi Accountants Consultants

Tanzania Revenue Authority Paye Slab Tra Paye Lenvica Hrms

Withholding Tax Rates To Non Residents Download Table

Treasury Bonds Prospectus Bank Of Tanzania

Https Www2 Deloitte Com Content Dam Deloitte Tz Documents About Deloitte Covid 19 20tanzania 20tax 20 20legal 20viewpoint Pdf

Itx 203 01 E Final Return Of Income

Tanzania To Reduce Income Tax From 11 To 9 In 2016 2017 Tanzaniainvest

Tra Tanzania Tax Calculator Paye Gst Vat Wht By Tonyoa Ventures Android Apps Appagg

Tanzania Revenue Authority Paye Slab Tra Paye Lenvica Hrms

Tanzania In Imf Staff Country Reports Volume 1998 Issue 005 1998

Post a Comment for "Withholding Tax Rates Tanzania"