Hmrc Update Self Employment Details

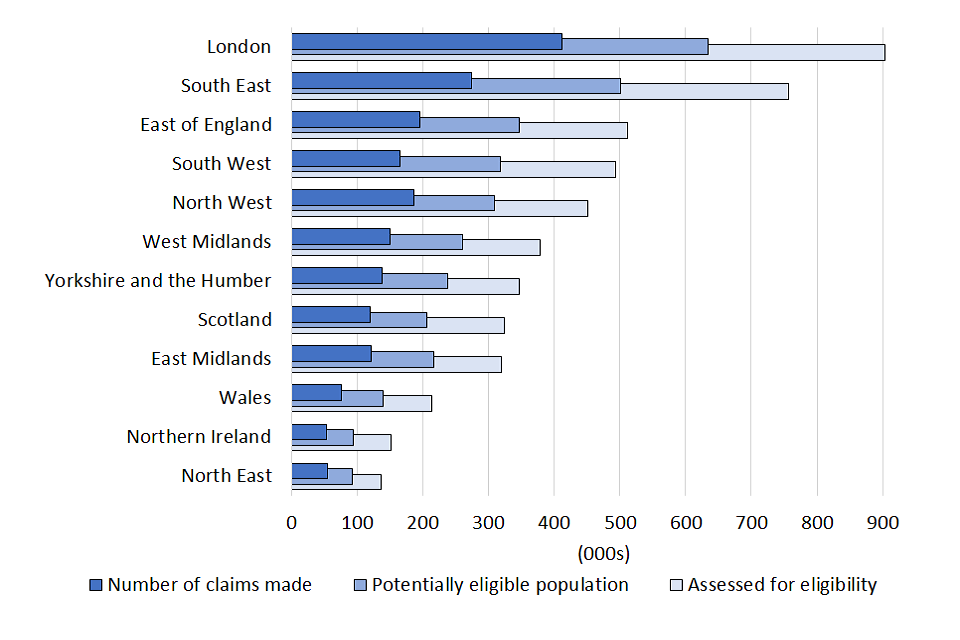

The Self-Employment Income Support Scheme claim service is now open. The latest figures from HM Revenue and Customs HMRC show that 91 million grants have been claimed in total by self-employed people across the UK since the scheme launched in May last year.

Hmrc Issues Warning To Anyone Self Employed Claiming Fifth Seiss Grant Cambridgeshire Live

Tell HMRC and pay back a Self-Employment Income Support Scheme grant.

Hmrc update self employment details. Tell HMRC when you change your address. HMRC confirms important deadline self-employed Britons must meet - act now Image. By Rebekah Evans PUBLISHED.

HMRC eligibility update for self-employed claiming fifth SEISS grant before applications open later this month Claims for the final Self-Employment Income. For further details of the changes to eligibility and calculation of the grant please visit GOVUK and search Self-Employment Income Support Scheme. What happens next HMRC will contact you from mid-April if we believe you may be eligible for the.

1 day agoThe government has paid out 252 billion to around 29 million self-employed people through Self Employment Income Support Scheme grants. While HMRC will be contacting eligible claimants directly over the next couple of weeks with more specific details you can now see if youre eligible to claim and what date youll be able to lodge your claim by using their on-line tool about half way. HM Revenue and Customs National Insurance Contributions and Employers Office.

HMRC issues update on self-employment grant 5 as three step criteria announced SEISS has undergone a major update today as HMRC has provided further details regarding the fifth and final. 0729 Mon Aug 9 2021. Getty But when making a claim there is an important deadline to bear in mind.

The UK government has provided 252 billion in financial aid to 29 million self-employed people whose businesses have been affected by the coronavirus through the Self-Employment Income Support Scheme SEISS. How to tell HMRC if theres a change to your personal details - address name income marital status. Other ways to update your details If youre self-employed or in a partnership you can write to the address on the most recent correspondence you have from HMRC or call the Income Tax helpline.

A failure to do so could mean Britons end up missing out on the financial support many will. Details about the fourth grant will be announced on 3 March 2021. 28 July 2020 Information about what to do if you were not eligible for the grant or have been overpaid has been added.

While HMRC will be contacting eligible claimants directly over the next couple of weeks with more specific details you can now see if youre eligible to claim and what date youll be able to lodge your claim by using their on-line tool about half way down their web page. Use this service to update your address for. To inform HMRC about changes to your business you can call HMRC on 0300 200 3210 or use our hassle-busting business change of address service.

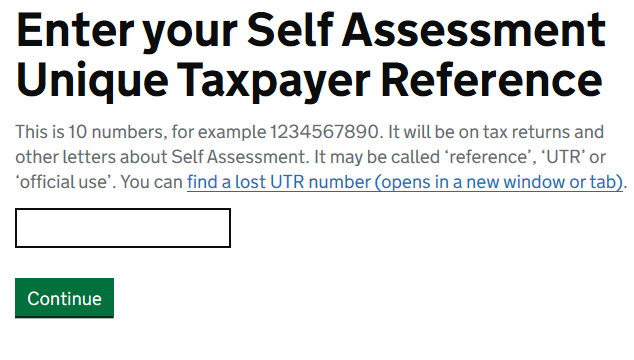

SEISS is formally known as the Self-Employment Income Support Scheme and has served as a lifeline for eligible Britons over the last year. HMRC has added a few updates for the self employed grant scheme. To sign in you need a Government Gateway user ID and password.

HMRC has issued an alert to self-employed individuals who are claiming the SEISS fifth grant in a warning which should be heeded. The latest figures from HMRC. HMRC will update your personal records for.

The Government scheme has offered help in the form of grants to cover the loss of trading profits many self-employed. HMRC has added a few updates for the self employed grant scheme. If you do not have a user ID you can create one.

Self-Employed HMRC update. You can also write to them by post at. HM Revenue Customs HMRC recently published guidance for self-employed workers who wish to claim a UK Government grant under the Coronavirus Self-Employment Income Support Scheme SEISS and moved.

New figures from HM Revenue and Customs HMRC show that 91 million grants have been applied for by self-employed across the UK since the.

Check If You Can Claim A Grant Through The Self Employment Income Support Scheme Newton Abbot Exeter Peplows

How To Complete A Self Assessment Tax Return With Pictures

Ir35 Tax Relief On Travel And Subsistence Limited Company Naming Your Business Tax Return

Seiss All You Need To Know About Grant 5 How To Apply When To Claim Eligibility Personal Finance Finance Express Co Uk

How To View And Download Your Tax Documents

Https Taxvol Org Uk Wp Content Uploads 2019 10 Completing Your Online Tax Return 2020 Pdf

Self Employment Income Support Scheme Statistics July 2021 Gov Uk

Your Self Employed Tax Return Youtube

How To Register As Self Employed Uk Startups Co Uk

Self Employment Income Support Scheme Statistics July 2021 Gov Uk

How To Register As Self Employed Uk Startups Co Uk

Seiss Grants Here S What You Need To Know Before The Fourth Round Opens This Month Leicestershire Live

What Are Allowable Expenses When Self Employed

When Does Hmrc Investigate Self Employed How To Avoid It Dns Accountants

How To Register As Self Employed In The Uk A Simple Guide

How To Register As Self Employed Uk Startups Co Uk

When Is The 4th Self Employed Grant How To Claim The Seiss Payment And Who Can Apply

Self Employment Income Support Scheme Statistics July 2021 Gov Uk

How To Submit Your Self Employment Income Support Scheme Claim Taxassist Accountants

Post a Comment for "Hmrc Update Self Employment Details"