Withholding Tax Rates In Zimbabwe

Dividends declared by a Zimbabwean company to a non-resident holding company will be subject to non-resident shareholders tax NRST a WHT. Otherwise the rate is 15.

Africa Tax In Brief 18 Feb 2020 Lexology

The rate of Value Added Withholding Tax shall be two thirds of the Output Tax.

Withholding tax rates in zimbabwe. The tax rate may be reduced under a tax treaty. A non-listed company is required to apply a withholding tax rate of 15 of the dividend. NRST is payable at a rate of 15 unless treaty relief is available.

Interest Bank interest from a Zimbabwean source is taxed at 15. What are the obligations of the Value Added Withholding Tax Agents. Otherwise the rate is 15.

Aug -Dec 2020 Tax Tables USDpdf. Did you know that in terms of Section 80 of the Income Tax Act Chapter 2306 a 10 percent withholding tax is deductible from all amounts payable to. Dividends from companies listed on the Zimbabwe Stock Exchange have a rate of 10.

With effect from January 1 2020 the rate of corporate tax was reduced from 25 percent to 24 percent. Interest Bank interest from a. A marginal reduction of the VAT standard tax rate from 15 to 145.

10 Withholding Tax is deducted when payments are made for goods and services supplied. Jan -Jul 2020 Tax Tables USDpdf. Up to ZWD 10000 - 0 ZWD 10001 up to 30000 - 20 ZWD 30001 up to 60000 - 25.

Where a Zimbabwe Stock Exchange-listed company pays a dividend to an individual the amount of withholding tax is 10 of the dividend this is to be paid to ZIMRA by the dividend issuer. Tax Tables USD 2020 Jan - Jul. Moreover the amount of fees charged by the head office to.

Withholding tax WHT also known as retention tax is an effective tool to combat tax evasion and facilitate easy collection of tax in Zimbabwe. Dividends With effect from 1 January 2010 dividends from securities listed on the Zimbabwe stock exchange are taxed at a rate of 10. Withholding Tax on non-executive directors fees.

Exemptions to this tax are POSB Tax Reserve certificates 4 Government six years bonds Building Society Class C shares and interest earned on foreign currency denominated account. The tax rate may be reduced under a tax treaty. It is proposed to review the corporate income tax rate from 25 to 24.

Dividends With effect from 1 January 2010 dividends from securities listed on the Zimbabwe stock exchange are taxed at a rate of 10. August to December 2020 PAYE RTGS Tax Tables. Amendments of specified amounts invarious tax provisions.

Aug -Dec 2020 Tax Tables RTGSpdf. Listed securities will be subject to withholding tax WHT at 1 on the gross proceeds. A company is resident in Zimbabwe if its central management and control is situated in the country.

Zimbabwe presently operates on a source-based tax system. It is a government requirement for the payer of income to withhold or deduct tax from the payment income accruing to the payee and remit that tax to Zimbabwe Revenue Authority ZIMRA. Using the chart you find that the Standard withholding for a single employee is 176.

Listed securities which have been subjected to the 1 WHT will be exempt from the normal 20 CGT. Withholding tax on non-executive directors fees to be final and not subject to a claimable tax credit Conditions to be introduced for venture capitalists to qualify for an income tax exemption Concerning VAT and indirect taxes. Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly.

You find that this amount of 2020 falls in the At least 2000 but less than 2025 range. Tax clearance is required when bidding for tenders. A supplementary budget was presented which proposed to increase government spending by 140 from ZW77 billion to ZW186 billion.

In cases where payment of the supply is made in instalments the tax shall be withheld on the output tax on each instalment. Interest paid from a source within Zimbabwe or payable by a person who is ordinarily resident in Zimbabwe to a non resident is charged withholding tax at 10. No Presumptive Tax will be levied on importations.

It is further proposed that a non-resident person liable to pay tax in Zimbabwe. The 3 aids levy still applies. Deductibility of mining royalties effective 010120.

Changes to rate of Capital Gains Tax and Capital Gains Withholding Tax. As of 1 January 2020 the corporate income tax CIT rate for companies other than mining companies with special mining leases but including branches is reduced to 2472 previously 2575. A 15 withholding tax is imposed on branches for any payment made in respect of head office charges.

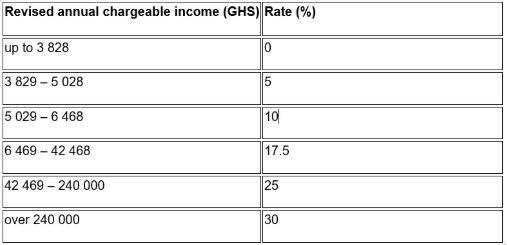

The adjustment of the tax bands so that taxation begins at ZWD 10001 per month and the top rate of 40 applies for income exceeding ZWD 250000 per month as follows. This rate includes a base rate of 24 plus a 3 AIDS levy.

Zimbabwe Revenue Authority Ppt Download

Understanding Withholding Tax In Zimbabwe Furtherafrica

A Guide To Using 2021 Paye Tax Tables

Understanding Withholding Tax In Zimbabwe Furtherafrica

Understanding Withholding Tax In Zimbabwe Furtherafrica

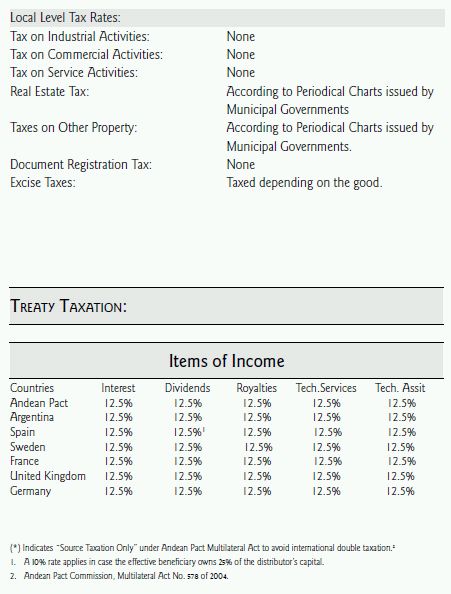

Managing Corporate Taxation In Latin American Countries El Salvador Tax El Salvador

Panama Tax Treaties Tax Panama

Islamic Republic Of Iran Selected Issues In Imf Staff Country Reports Volume 2017 Issue 063 2017

Dentons Global Tax Guide To Doing Business In Zimbabwe

Understanding Special Economic Zones In Zimbabwe Furtherafrica

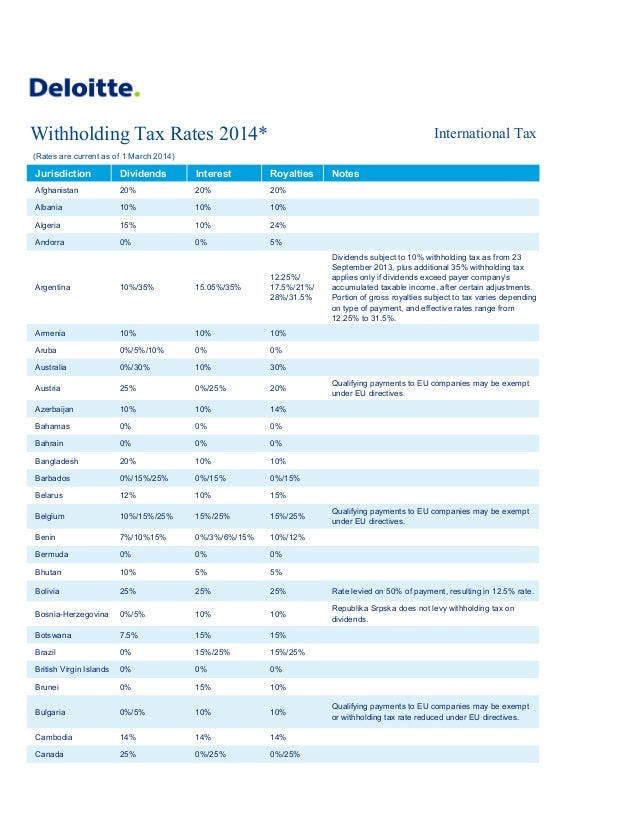

Withholding Tax Rates By Country Money Master Tutorials

Http Www Taxindex De Download The Tax Attractiveness Index Methodology 2017 August Final Pdf

Managing Corporate Taxation In Latin American Countries Bolivia Tax Bolivia

Post a Comment for "Withholding Tax Rates In Zimbabwe"