Withholding Tax Rates In Us

An official website of the United States Government. You must meet all of the treaty requirements before the item of income can be exempt from US.

Doing Business In The United States Federal Tax Issues Pwc

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income.

Withholding tax rates in us. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. However for many business entities and sole proprietors this tax can be brought to a reduced rate or exempt completely. These are the rates for taxes.

Your bracket depends on your taxable income and filing status. US Tax law requires US. If you are an employee your.

The QI gives you a Form W-8IMY with which it associates the Form W-9 and a withholding statement that allocates 40 of the dividend to a 15 withholding rate pool 40 to a 30 withholding rate pool and 20 to the US. Prime Ministers package for construction sector. Dividends paid by a local entity to a local individual are subject to income tax withholding.

There are seven federal tax brackets for the 2020 tax year. The tax rate applicable is 7 percent for the fiscal year 2020 and 13 percent as of FY 2021. How do I reduce my taxes.

Based companies like Monotype to withhold 30 of any royalty payments to non US. More details about the Tax Withholding Estimator and the new 2020 withholding tables can be found on the Frequently Asked Question pages. For example the US Government charges non-US residents withholding tax of 30 on any.

Withholding tax is a tax levied by an overseas government on dividends or income received by non-residents. The rates vary between 5 15 and 20 based on the type of service and whether the beneficiary is a related party. You should report on Forms 1042-S 40 of the payment as made to a 15 rate dividend pool and 40 of the payment as made to a 30 rate dividend pool.

132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25. Source gross income that is not effectively connected with a US. 61 Zeilen Under US domestic tax laws a foreign person generally is subject to 30 US tax on a.

Corporate - Withholding taxes Last reviewed - 31 December 2020 Payments made from a resident party or a PE to a non-resident party for services performed are subject to WHT. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. FAQs on the 2020 Form W-4 Tax Withholding Estimator IRS Tax Withholding Estimator.

Applicable Withholding Tax Rates. Withholding tax at rates ranging from 5 to 10 of gross payment in lieu of profit tax. 25 0 0 The Parliament has adopted a 15 withholding.

10 12 22 24 32 35 and 37. Updated up to June 30 2020. All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source payments such as dividends interest and royalties.

To amounts paid or credited after 31 December 2020 for purposes of non-resident WHT and for taxation years beginning after 31 December 2020 for other taxes. Tax Withholding Estimator FAQs. Before that the rates were 25.

12 Zeilen For US. The part of the payment allocable to the US. 27 rate imposed on taxable profits of main exporting pipeline participants.

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

Http Www Kcca In Services For Indian Entities Taxation Excise And Customs Starting A Business Small Scale Business Business

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Global Corporate And Withholding Tax Rates Tax Deloitte

Payroll Tax What It Is How To Calculate It Bench Accounting

Fillable Form 1040 2018 Irs Taxes Tax Forms Income Tax Return

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return How To Find Out Income Tax Return Business Tax

Brazilian Withholding Taxes Bpc Partners

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Payroll Tax Services

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Who S Responsible For Firpta Withholding On The Sale Of U S Property Harding Bell International Capital Gains Tax What Is Capital Capital Gain

Tax Flowchart Do You Have To File A Return Flow Chart Law School Humor Flow Chart Template

Global Corporate And Withholding Tax Rates Tax Deloitte

Step By Step Document For Withholding Tax Configuration Sap Blogs

Brazilian Withholding Taxes Bpc Partners

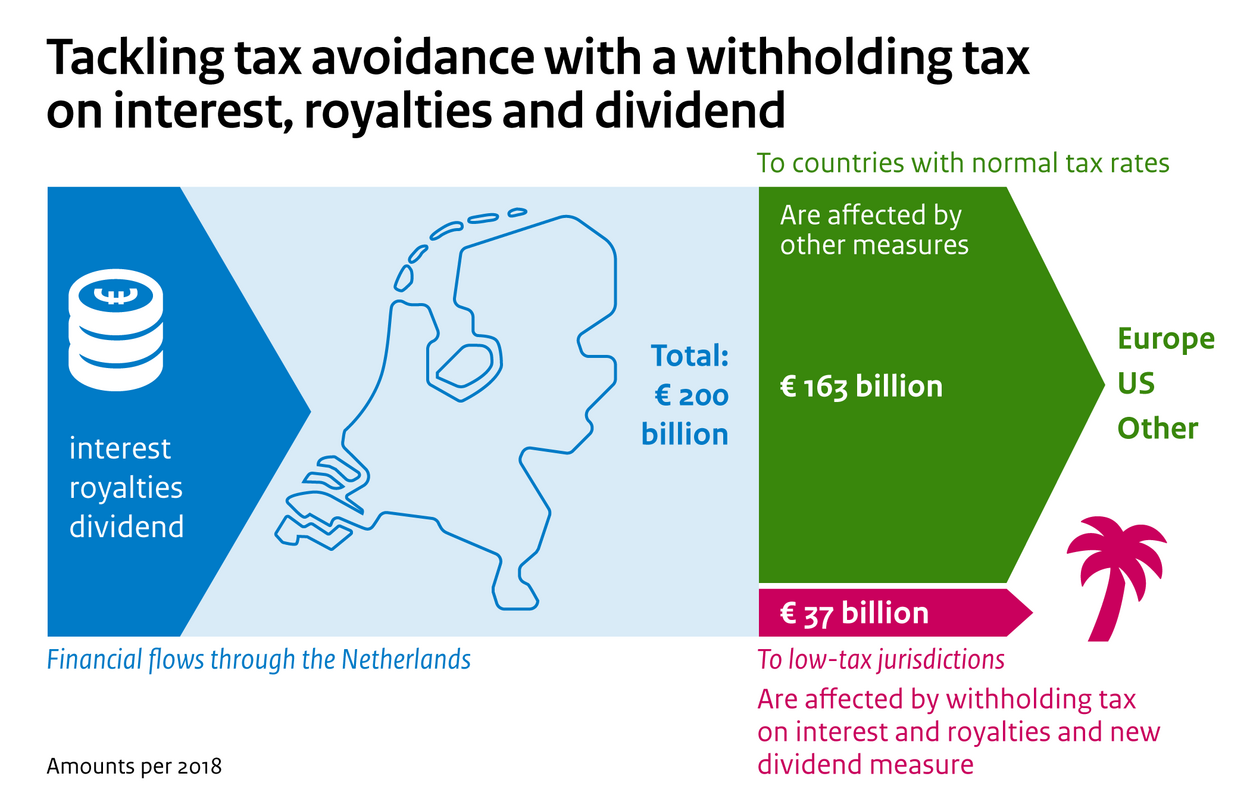

Dividend Withholding Tax Bill Submitted News Item Government Nl

Post a Comment for "Withholding Tax Rates In Us"