Withholding Tax Rate On Royalties By Country

If the payment is made to a resident of a country which has a tax treaty with Australia that treaty sets the rate of withholding which is required. 25 or more of the capital in the other.

Tax Treaties Database Global Tax Treaty Information Ibfd

Income tax including the requirement that the income be remitted to your country of residence if that is a.

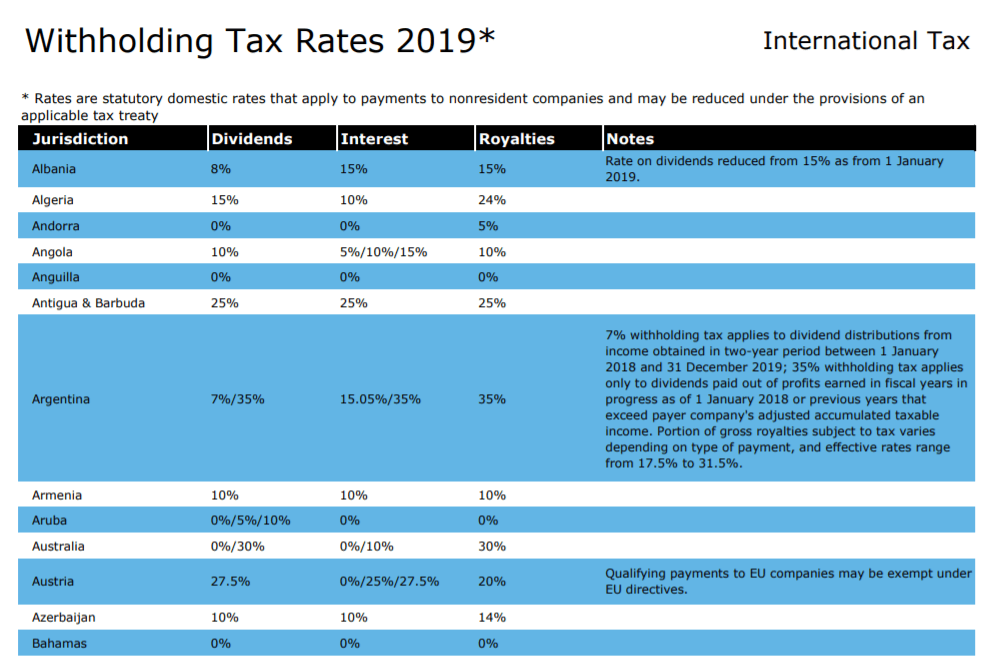

Withholding tax rate on royalties by country. If there is no tax treaty the rate will be 30. Royalties paid is taxed at a final withholding tax rate of 15. As a result Canada will impose a maximum WHT rate of 25 on dividends interest and royalties until a new treaty enters into force.

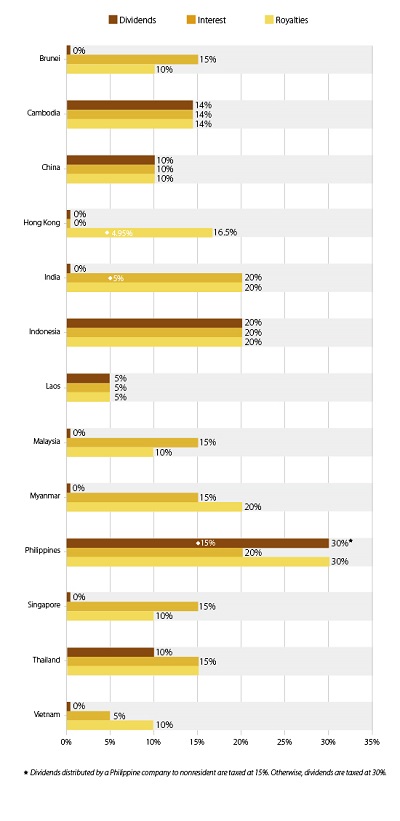

Pakistan Last reviewed 15 July 2021. Belarus Tajikistan and Turkmenistan will not honour the treaty with the former USSR. 233 Zeilen other royalties However Thailand shall tax at the rate not exceeding 10.

Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25. Royalties paid to a foreign entity is subject to withholding tax at a tax rate of 25 percent 35 percent if paid to a resident of a black-listed country or if paid or made available in accounts in the name of 1 or more holders acting on behalf of undisclosed 3rd parties. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

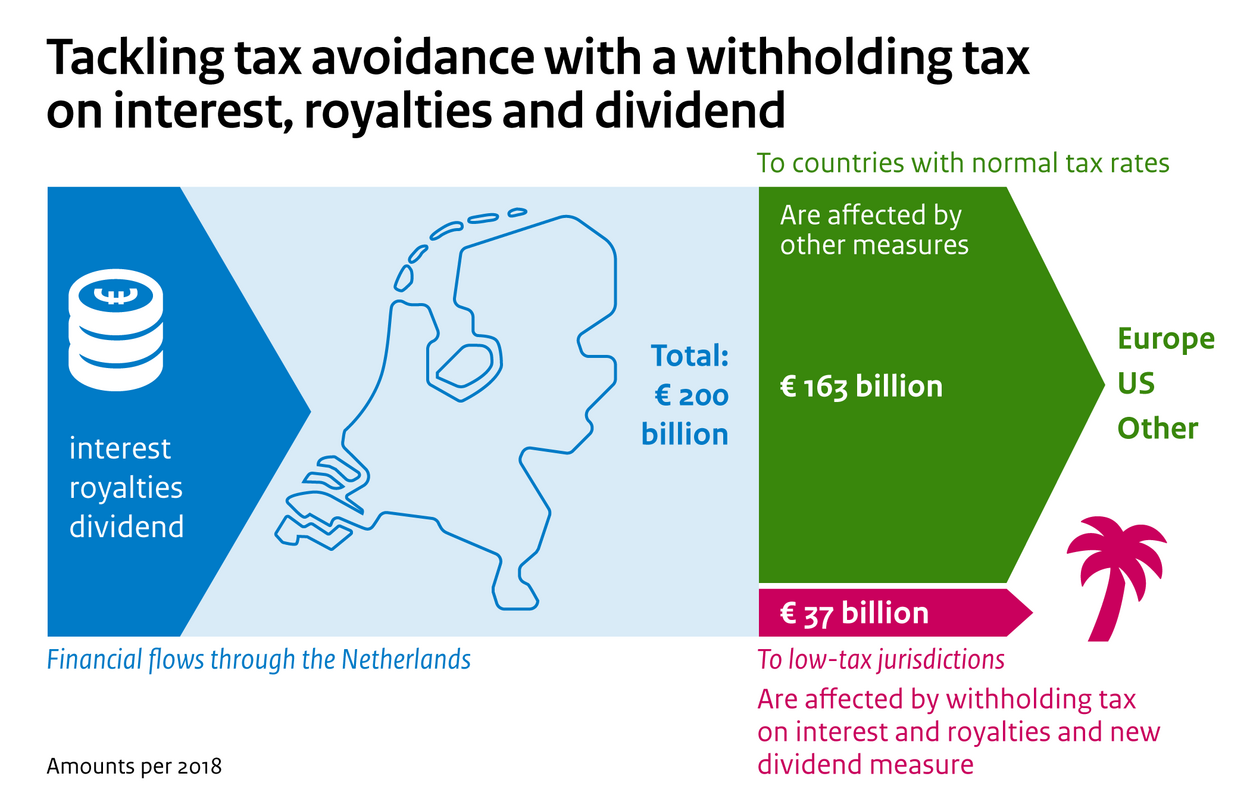

The amount withheld in taxes varies wildly by nation. Corporate Tax Rates 2021. Similarly the EU interest and royalties directive removes withholding taxes from payments of interest and royalties between associated companies.

30 for unfranked dividend and royalty payments. You must meet all of the treaty requirements before the item of income can be exempt from US. Lower rate for loans from banks and financial institutions.

These are mentioned in this table even though there may be no UK WHT applied under domestic law. Royalties are not subject to withholding tax if the EU Interest Royalty Directive applies. All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source payments such as dividends interest and royalties.

The lower rate 5 applies to royalties paid for the use of or the right to use any copyright of literary artistic or scientific work. 25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments with an effective date of 1 July 2021 1 October 2021 for lease payments. 25 or more of the voting rights in the other.

What steps should I take. No negotiations are underway. Where withholding tax on royalties was withheld by a withholding agent a Return for Withholding Tax on Royalties WTR01 form must be submitted to lbqueriessarsgovza with proof of payment for taxpayers that deal with Large business.

The 7 rate applies to royalties paid for. 31 Zeilen US Tax law requires US. Tax treaties are special agreements that Australia has entered into with over 40 countries.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income. These rates apply to all payees unless. Many treaties allow reduced rates for a wider range of royalties.

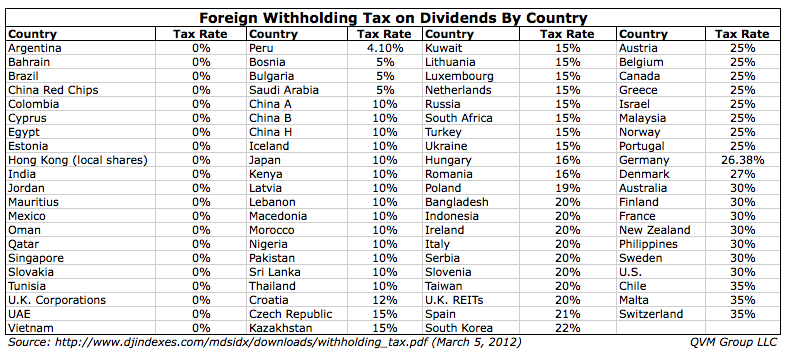

Foreign Dividend Withholding Tax Rates by Country. The foreign withholding rate can vary wildly. 0 0 10.

Corporate Tax Rates 2021 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax. The lowest rate 3 applies to royalties paid for the use of or the right to use any item of news. The payment is made to a resident of a country which has a tax treaty with Australia a.

Based companies like Monotype to withhold 30 of any royalty. Here is the withholding tax rate for some of the largest countries. Oman Last reviewed 24 June 2021 Resident.

The withholding tax rate may be reduced under a tax treaty. The definition of associated is different in this case one of the companies must directly hold. The tax treaties help prevent the same income being taxed more than once.

25 15 effective rate for Americans due to tax treaty China mainland.

Is Dividend Withholding Tax Important In Investing Investment Moats

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

Panama Tax Treaties Tax Panama

Dividend Withholding Tax Bill Submitted News Item Government Nl

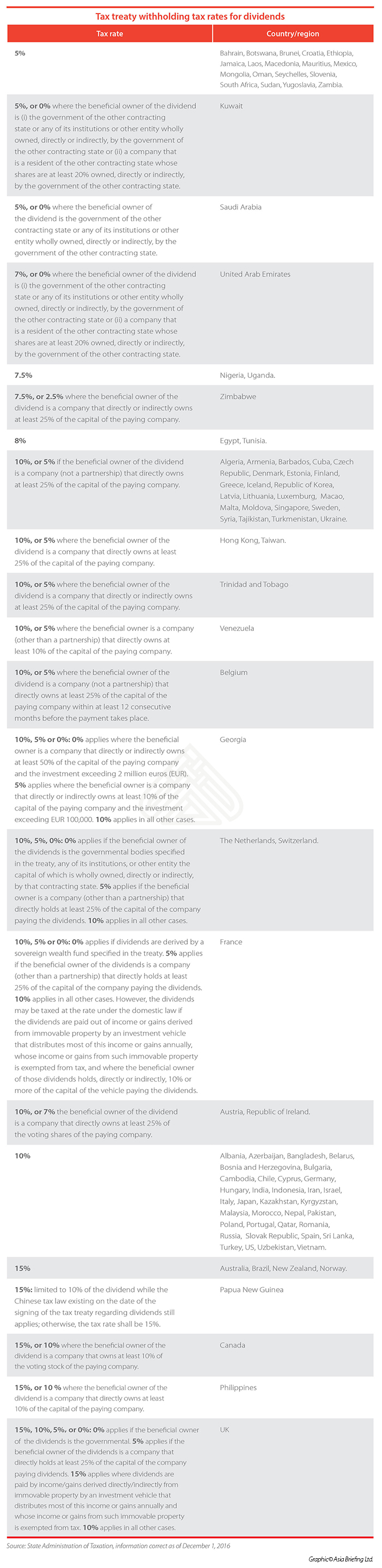

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Doing Business In The United States Federal Tax Issues Pwc

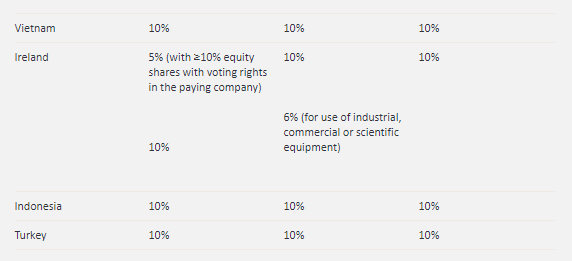

Analysis Of Asia S Tax Rates Part 2 Withholding Tax Asia Business News

Withholding Tax In China China Briefing News

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

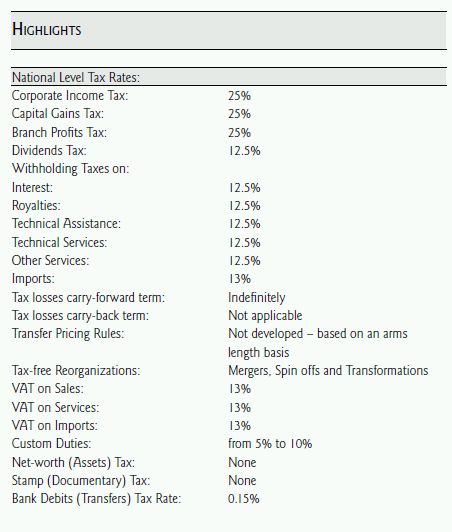

Managing Corporate Taxation In Latin American Countries Bolivia Tax Bolivia

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Tax Form W8ben Step By Step Guide Envato Author Help Center Tax Forms Guide Step Guide

Global Corporate And Withholding Tax Rates Tax Deloitte

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Myanmar Tax Update Myanmar Withholding Tax Rates To Be Slashed

Post a Comment for "Withholding Tax Rate On Royalties By Country"