What Is The Pa Unemployment Tax Rate For 2020

Register for employer withholding tax online through the Online PA-100. You can also see Pennsylvania unemployment compared to other states.

This law change occurred after some people filed their 2020 taxes.

What is the pa unemployment tax rate for 2020. What is PA unemployment tax rate for 2020. The IRS announced it will automatically issue refunds for the unemployment tax break. People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation.

What is the PA unemployment tax rate for 2020. A 54 percent 054 Surcharge on employer contributions. Employees are to be assessed an unemployment tax rate of 006 unchanged from 2020 with the tax deductible from wages.

Whether youre wondering how to claim the unemployment tax break if you already filed or are getting ready to do so Block has your back. Pennsylvanias unemployment taxable wage base which is to be 10000 for 2021 does not apply with regard to unemployment tax assessed on employees. Wages subject to unemployment contributions for employers remains at 10000.

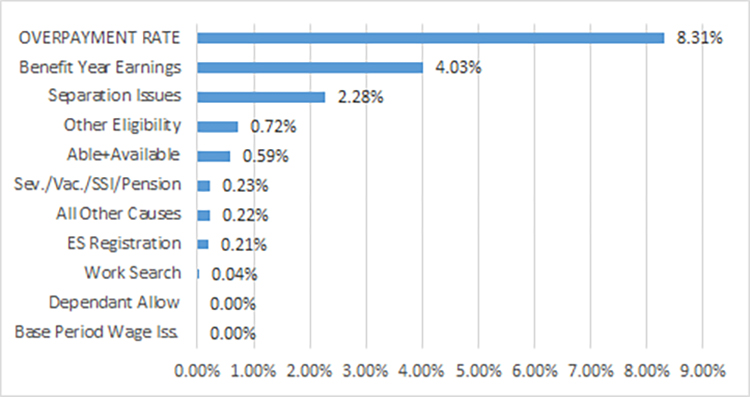

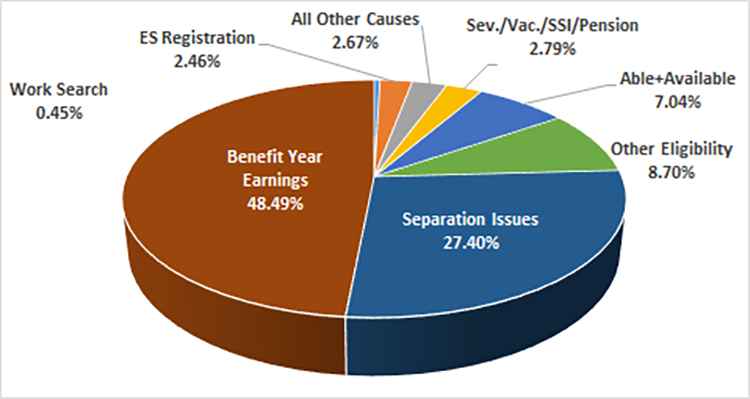

Employer UC tax services important information Pennsylvania Department of Labor Industry website November 2019 As a result the calendar year 2020 employer state unemployment insurance SUI experience tax rates will range from 12905 to 99333 down from 23905 to 110333 for 2019. The employers can claim this maximum credit of 54 if they satisfy both the conditions below. The unemployment rate in Pennsylvania peaked in April 2020 at 162 and is now 93 percentage points lower.

52 Zeilen SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama. Information for people who already filed their 2020 tax return. Employers can file and pay employer withholding tax returns and submit W-2 information online using e-TIDES by phone using TeleFile or through third-party software.

How do I file Pa withholding tax. PAs Unemployment Compensation Tax Rate Reduced. For details visit wwwdcedpagov.

All other eligible taxpayers can exclude up to 10200 from their income. For 2020 the FUTA tax rate is projected to be 6 per the IRS. A 050 percent 0050 Additional Contributions.

Paid state unemployment taxes on time in full. How much do Bonuses get taxed in PA. The surcharge adjustment is computed by multiplying your basic rate by the 54 percent surcharge.

HR Block is here to help. During the most recent recession Pennsylvanias unemployment trust fund became insolvent which resulted in the need to borrow from the federal government through a Title XII Loan. The effective tax rate for 2020 is 06.

Appealing a UC Tax Rate. The Interest Factor was 110 in 2019 but in 2020 it is reduced to 000. The FUTA tax applies to the first 7000 in wages you pay an employee throughout the calendar year.

City of Philadelphia Wage Tax Effective July 1 2019 tax rates are 38712 for Philadelphia residents and 34481 for nonresidents. This 7000 is known as the taxable wage base. Pennsylvania Unemployment Tax The employee rate for 2020 remains at 006.

If the employer is eligible for the maximum credit it means that the tax rate will be only 06 ie. 56 Zeilen 2019 legislation LB 428 increases the SUI taxable wage base to 24000 for. The result is added to the basic rate.

What is the PA withholding tax rate for 2020. Its worth noting that youll also need to pay SUTA taxes thanks to the State Unemployment Tax Act for your employees as well. One reason for this is the decrease of one of the components that make up the tax rate.

The state unemployment rate was 11 percentage points higher than the national rate for the month. The surcharge adjustment does not apply to reimbursable employers. For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment.

If your bonus totals more than 1 million the withholding rate for any amount above 1 million increases to 37 percent. The IRS will start with most taxpayers who are eligible for the up to 10200 unemployment. What you should do now.

For employers unable to access UCMS a written appeal will be accepted if received within 90 days of the mailing date of the rate notice. Federal Unemployment Tax The wage base remains at 7000. Tom Wolf on Wednesday announced Pennsylvania businesses will see a reduction in their unemployment compensation UC tax rates saving an estimated 552 million this yearThe Department of Labor Industry eliminated the 11 percent UC tax rate interest factor effective Jan.

An employer who wishes to appeal a contribution rate may do so by accessing the UCMS employer self-service portal at wwwuctaxpagov. The percentage method The withholding rate for supplemental wages is 22 percent. Wages subject to unemployment contributions for employees are unlimited.

These will start going out in June and continue through the summer. Written appeals should be sent to the Department of Labor Industry Office of UC Tax Services Employer Account Services PO Box 68568 Harrisburg PA. These rates are adjusted by the City of Philadelphia on July 1 of each year.

All It Takes Is A Big Unexpected Expense Or A Few Months Of Unemployment And You Re Behind On Your Mortgage Or Tax Pa Tax Payment Unexpected Expenses Mortgage

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

1099 G Tax Form Why It S Important

Pennsylvania How Unemployment Payments Are Considered

Unemployed Pennsylvanians Will Get An Extra 300 A Week

Zip Code 19342 Profile Map And Demographics Updated March 2020 Demographics Coding Map

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

The 2020 Tax Season Has Started Here S How You Can File Free And When To Expect A Refund Check Tax Return Tax Season Tax

Pennsylvania Tax Rate H R Block

1099 Tax Forms Available Soon For Pa Unemployment Claimants Erie News Now Wicu And Wsee In Erie Pa

Post a Comment for "What Is The Pa Unemployment Tax Rate For 2020"