Withholding Tax Rates Tax Treaty Countries

Withholding Tax Rate Afghanistan No 30 Albania No 30 Algeria No 30 American Samoa No 30 Andorra No 30 Angola No 30 Anguilla No 30 Antarctica No 30 Antigua and Barbuda No 30 Argentina No 30 Armenia Yes 30 Aruba No 30 Australia Yes 15 Austria Yes 15 Azerbaijan Yes 30 Bahamas No 30 Bahrain No 30 Bangladesh Yes 15. In particular non-resident companies that are subject to UK income tax on UK-source rental profits see the Taxes on corporate income section for more information will find their letting agent or tenants are obligated to withhold the appropriate tax at source currently 20 without any allowances from their rental payments unless the recipient has first applied and been given permission to receive.

Tax Treaties Database Global Tax Treaty Information Ibfd

In other situations withholding agents may apply reduced rates or be exempted from the requirement to withhold tax at source either under domestic law exceptions or when there is a tax treaty between the foreign persons country of residence and the United States that provides for such reduction or exemption.

Withholding tax rates tax treaty countries. 15 10 0 but VAT 19 unless exempted. Information is provided as a courtesy and is not guaranteed to be up to date. Country Year of entry into effect Dividends Interest Royalties.

92 Zeilen 15 Note1 a 15 of royalty relating to literary artistic scientific works other. 77 Zeilen Treaty countries. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate.

Rate of withholding tax Interest. This page contains information on tax withholding rates for countries with tax treaties with the US. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US.

For example there is a 23 withholding tax rate on payments for film or video acting services and a 15 withholding tax rate. With some variation the topics covered are taxes on corporate income and gains determination of trading income other significant taxes miscellaneous matters including foreign-exchange controls debt-to-equity rules transfer pricing controlled foreign companies and anti-avoidance legislation and treaty withholding tax rates. At the back of this Tax Guide you will find a list of the names and codes for all.

DOUBLE TAXATION AGREEMENTS WITHHOLDING TAX RATES No. Royalties are not subject to withholding tax if the EU Interest Royalty Directive applies. Taxable amounts paid or credited to payees in countries with which Canada does not have a tax convention in force are subject to the withholding tax rates set out in Part XIII and Part XIII2 of the Act.

The 25 Part XIII tax will apply to any taxable amounts you paid or credited to persons in non-treaty countries. Royalties paid to a foreign entity is subject to withholding tax at a tax rate of 25 percent 35 percent if paid to a resident of a black-listed country or if paid or made available in accounts in the name of 1 or more holders acting on behalf of undisclosed 3rd parties. Withholding tax on dividends interest and royalties under tax treaties.

Although Part XIII generally specifies a withholding tax rate of 25 there are some exceptions. DITS includes current rates for corporate income tax. Income taxes on certain income profit or gain from sources within the United States.

Corporate Tax Rates 2021. Country Treaty with US. 2 Non-Resident Withholding Tax Rates for Treaty Countries Non-Resident Withholding Tax Rates for Treaty Countries 133 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 France 10 515 010 25 Gabon 10 15 10 25 Germany 10 515 010 025 Greece 10 515 010 1525 Guyana 15 15 10 25 Hong Kong 10 515 10 25 Hungary 10 515 010 101525.

The withholding tax rate may be reduced under a tax treaty. Corporate Tax Rates 2021 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax. The Deloitte International Tax Source DITS is an online database featuring tax rates and information for 66 jurisdictions worldwide and country tax highlights for more than 130 jurisdictions.

The United States has entered into income tax treaties with more than 60 countries. In other words the tax authoritys position was that if it did not agree with the economic reasonableness of the transaction with a non-resident and that the transactions principal purpose was to obtain the reduced withholding rate benefits under the treaty the taxpayer may be subject to a rate of withholding tax at 15 plus penalties. The 25 Part XIII tax also applies to payees in countries with which Canada has a tax treaty that is not yet in effect.

Country Fees for Technical Services 1 Albania NIL 10 10 10 2 Australia NIL 15 10 NIL 3 Austria NIL 15 10 10 4 Bahrain NIL 5 8 10 5 Bangladesh NIL 15 10 10 6 Belgium NIL 10 10 10 7 Brunei NIL 10 10 10 8 Canada NIL 15 10 10 9 Chile NIL 15 10 5 10 China NIL 10 10 10 11 Croatia NIL 10 10 10. 15 10 30 unless rates provided by Double tax treaties Angola Last reviewed 24 June 2021 Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola. Other Tax Rates 2 Non-Resident Withholding Tax Rates for Treaty Countries 135 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 France 10 515 010 25 Gabon 10 15 10 25 Germany 10 515 010 025 Greece 10 515 010 1525 Guyana 15 15 10 25 Hong Kong 10 515 10 25 Hungary 10 515 010 101525 Iceland 10 515 010 1525.

Withholding tax rates in the source country Irelands treaty partner for dividend interest and royalty payments. Furthermore the tax authority asserted that it could raise the.

Https Www Pwc Com Gx En Asset Management Real Estate Tax Services Newsalert Assets Pwc Germany New Double Tax Treaty Signed Between Germany And Luxembourg Pdf

![]()

Tax Liability In Germany Gofrankfurttax

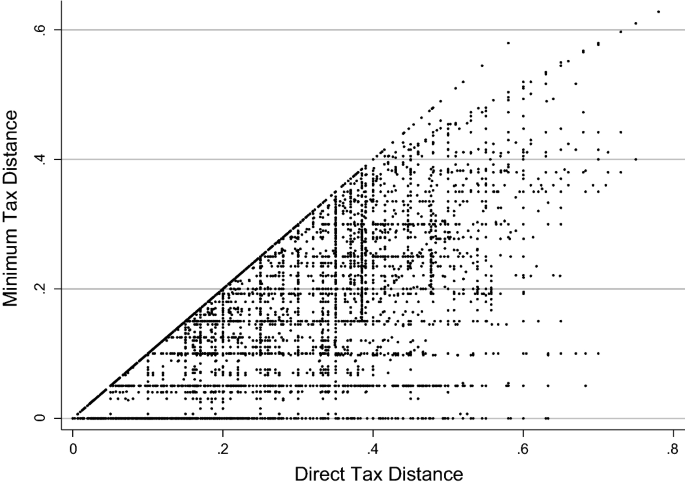

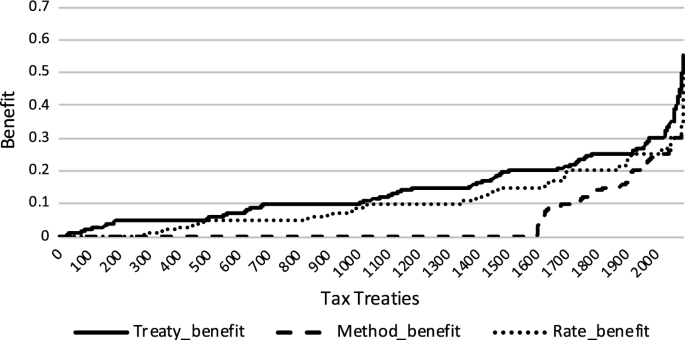

On The Relevance Of Double Tax Treaties Springerlink

Panama Tax Treaties Tax Panama

Global Corporate And Withholding Tax Rates Tax Deloitte

What Is The U S Germany Income Tax Treaty Becker International Law

Irs Publication 54 Tax Guide For U S Citizens And Resident Aliens Abroad Tax Guide Filing Taxes Irs

Tax Treaties Database Global Tax Treaty Information Ibfd

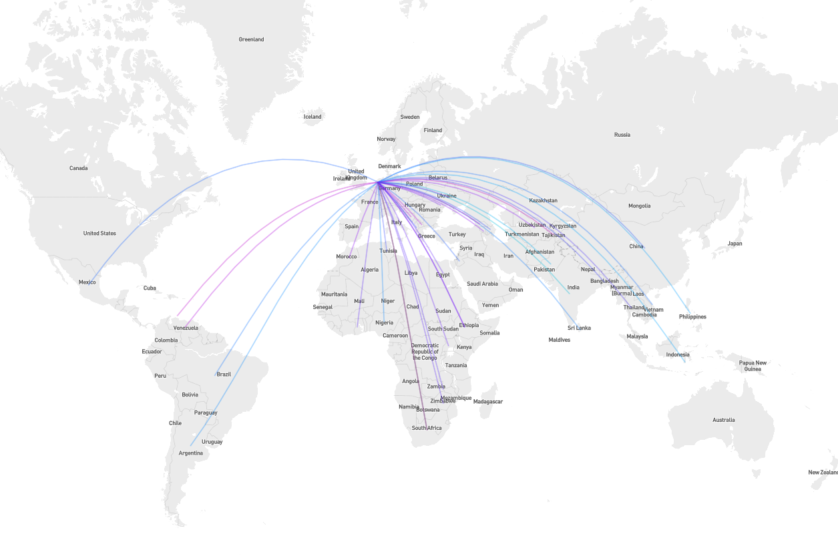

Russia S Double Tax Treaty Agreements Russia Briefing News

On The Relevance Of Double Tax Treaties Springerlink

Russia S Double Tax Treaty Agreements Russia Briefing News

Global Corporate And Withholding Tax Rates Tax Deloitte

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Withholding Tax Rates To Non Residents Download Table

Have The Netherlands Tax Treaties With Developing Countries Become Fairer Ictd

Federal Ministry Of Finance Double Taxation

Income Tax In Germany For Foreigners Academics Com

Post a Comment for "Withholding Tax Rates Tax Treaty Countries"