Weekly Withholding Tax Table 2020

The tables include federal withholding for year 2020 income tax FICA tax Medicare tax and FUTA taxes. And can be found here.

Payroll Tax What It Is How To Calculate It Bench Accounting

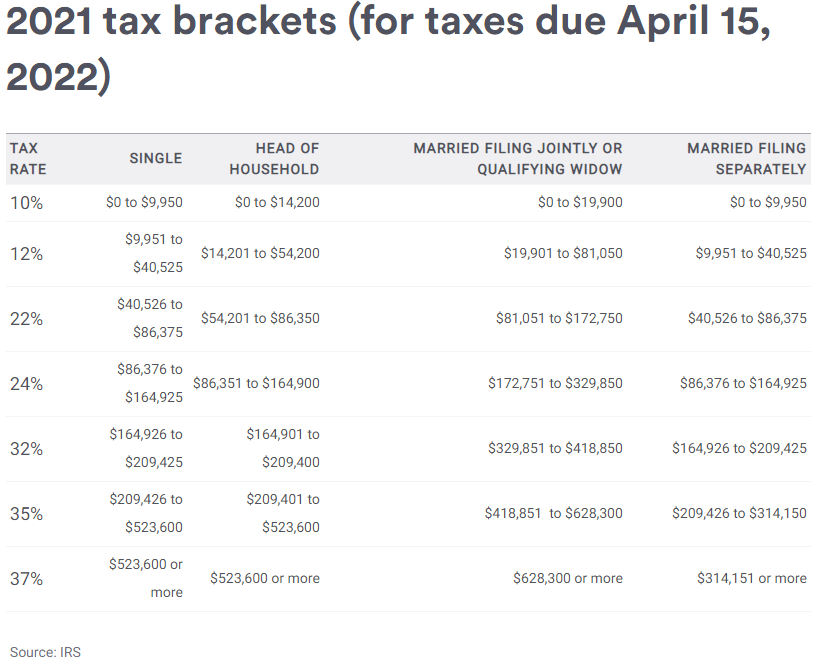

The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Weekly withholding tax table 2020. Salary wages allowances and leave loading to employees. 446-T 2020 Michigan Income Tax Withholding Tables Created Date. 2020 MISSOURI INCOME TAX WITHHOLDING TABLE.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. Read even more to comprehend just how the procedure works officially. ICalculator aims to make calculating your Federal and State taxes and Medicare as simple as possible.

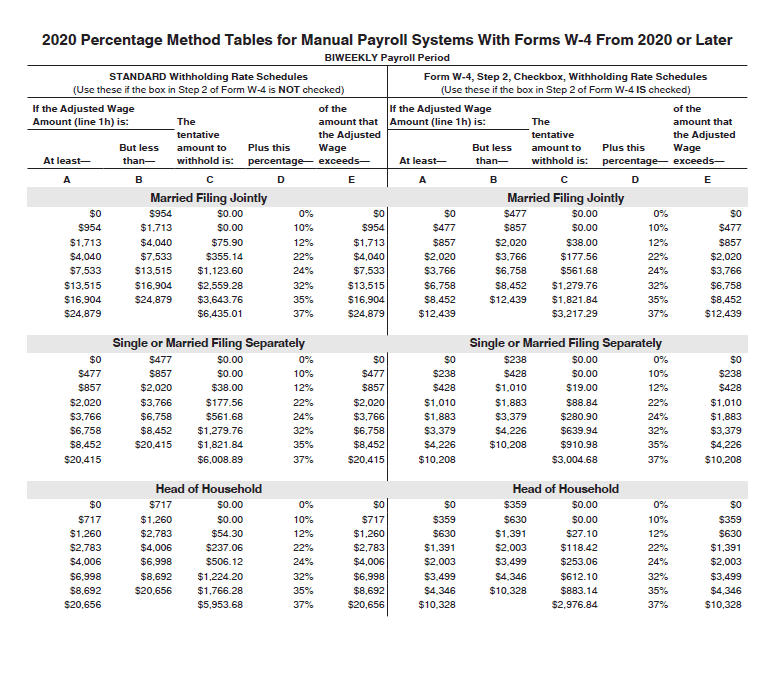

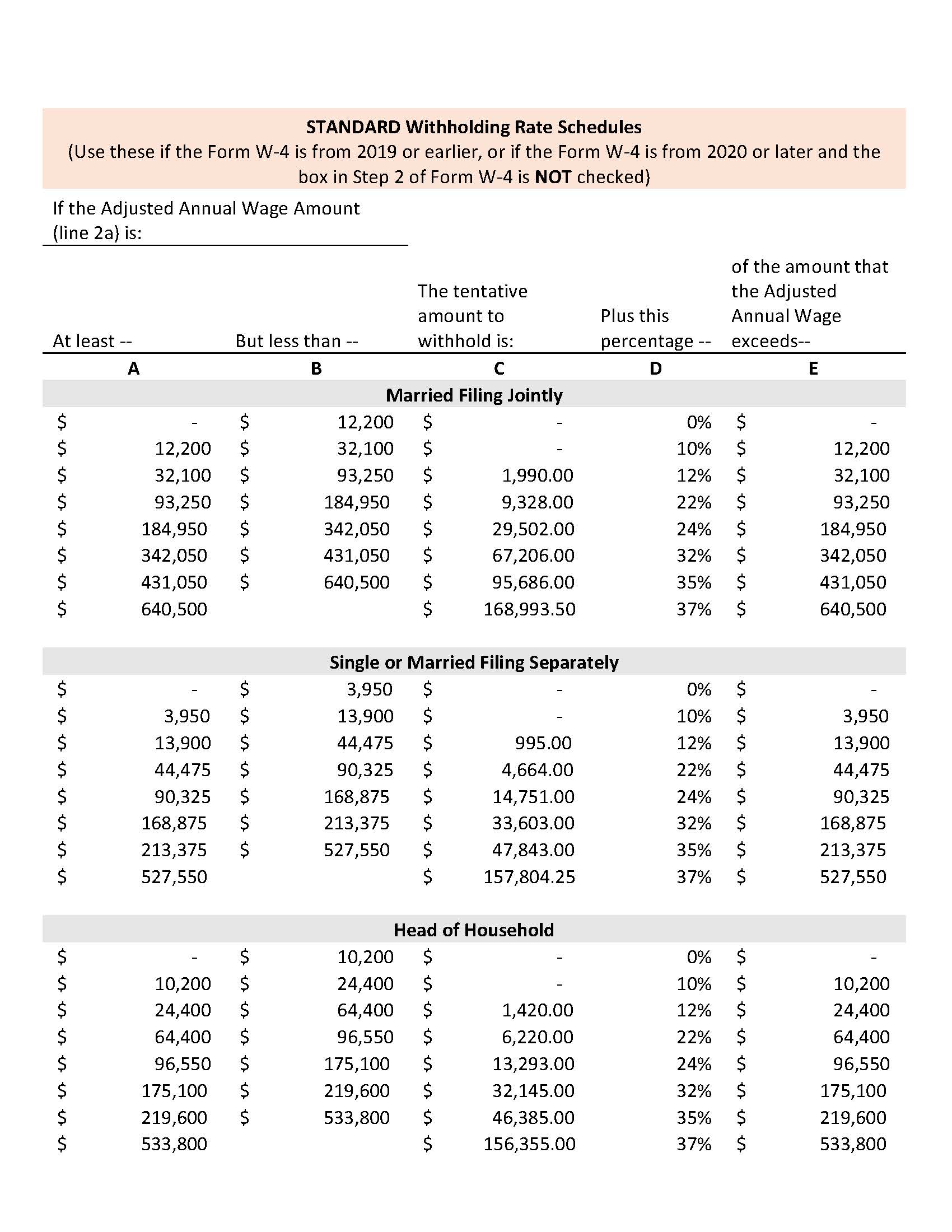

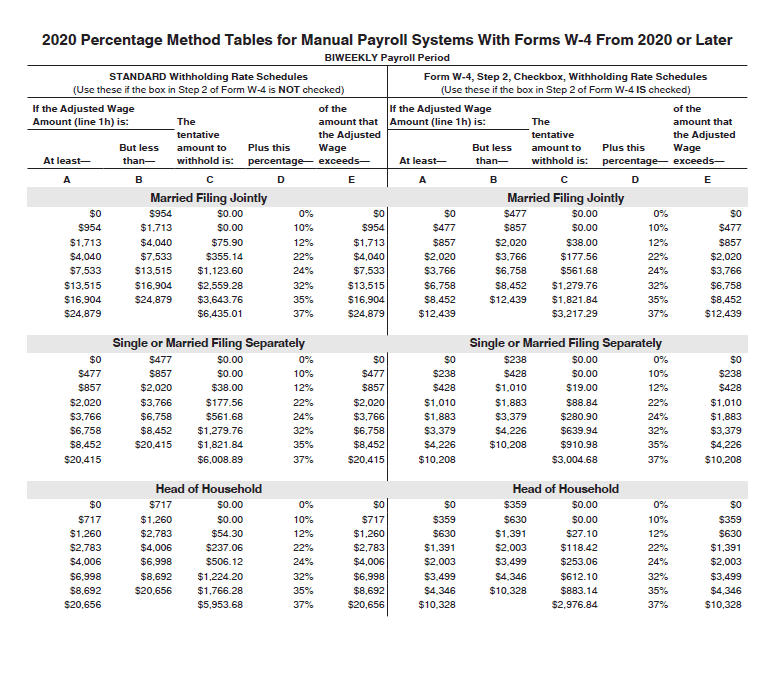

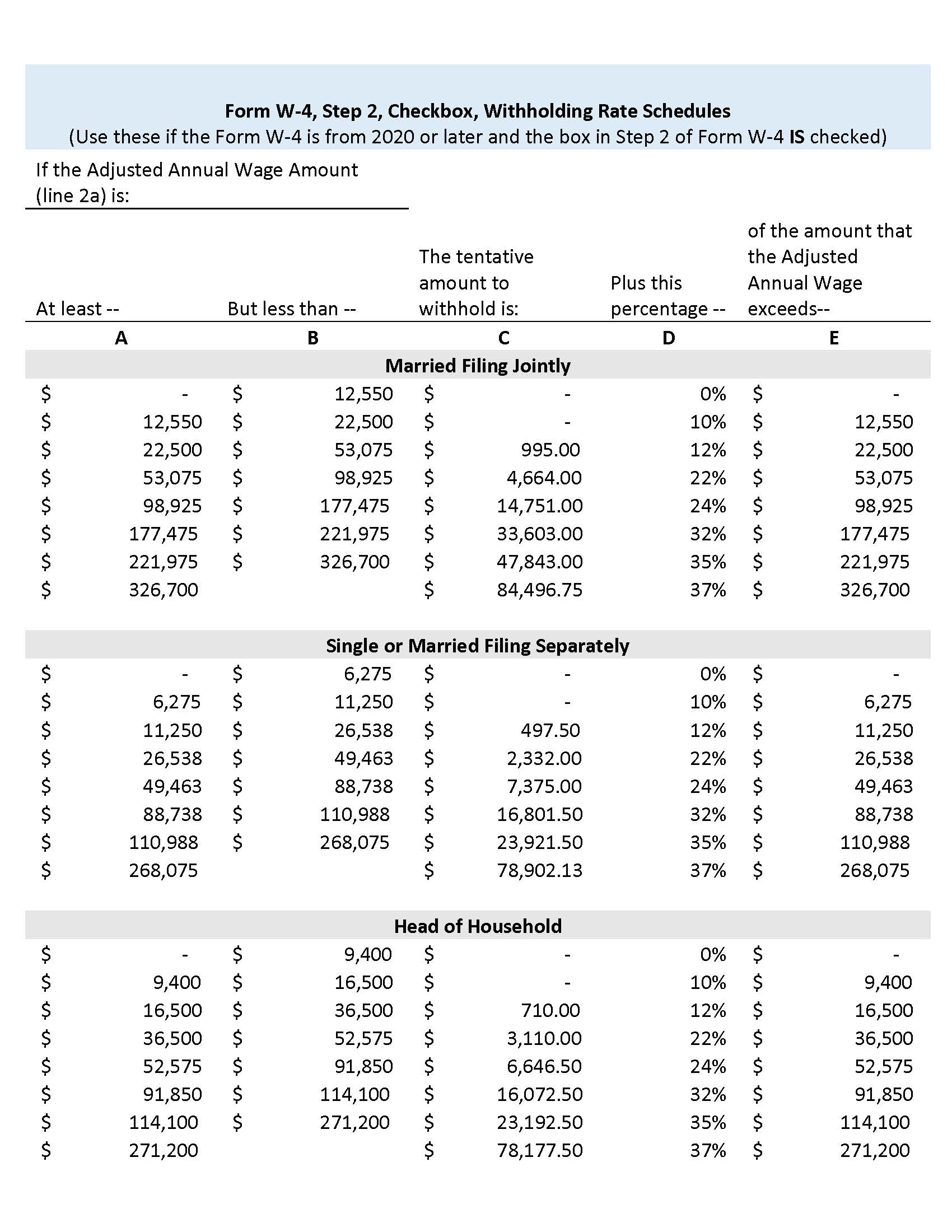

For Wages Paid in 2020 The following payroll tax rates tables are from IRS Publication 15 T. Federal Percentage Method of Withholding. These charts are for single or head of household.

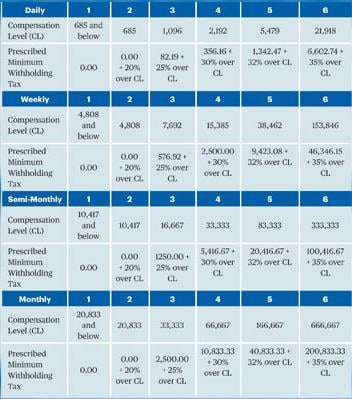

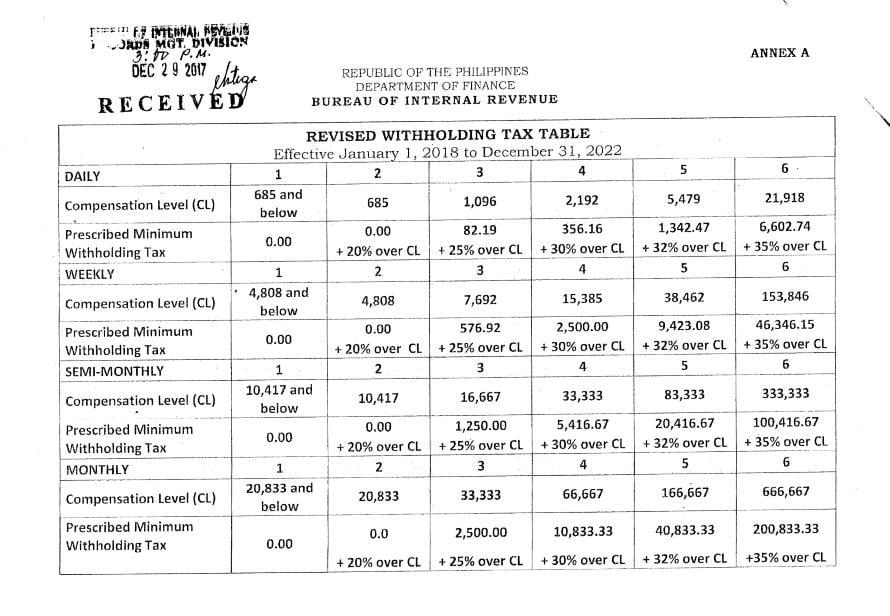

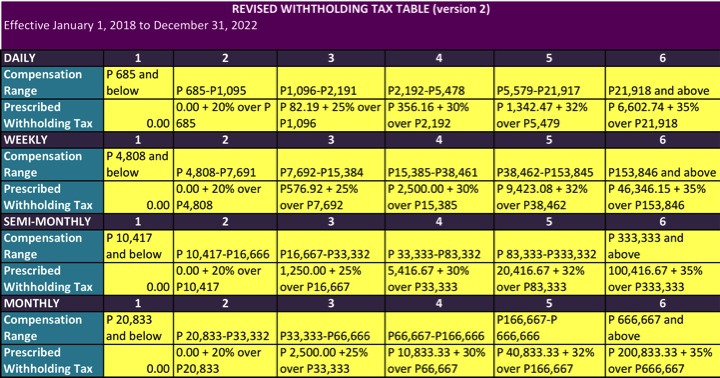

More details about the Tax Withholding Estimator and the new 2020 withholding tables can be found on the Frequently Asked Question pages. P8219 25 over P1096. 000 20 over P685.

For help with your withholding you may use the Tax Withholding Estimator. We produce a range of tax tables to help you work out how much to withhold from payments you make to your employees or other payees. At Least But Less Than.

The amount to be withheld under the withholding tables is based on existing rates the standard deduction and statutory exemptions. 1390 1405 43 30 17 1405 1420 43 30 18 1420 1435 44 31 18 1435 1450 45 32 19 1450 1465 46 33 20 1465 1480 47 34 21. The tables provided in this booklet are to be used for ALL employees unless the employee has requested on the Withholding Exemption Certificate that tax be withheld at a lower rate.

This year of 2021 is additionally not an exemption. 2020 AR Tax Table Change Notice to Employers 2020 AR Withholding. P134247 32 over P5479.

Using the chart you find that the Standard withholding for a single employee is 176. Categories Federal Tax Withholding Tables Tags federal withholding tax table federal withholding tax table 2019 federal withholding tax table 2020 vs 2021 federal withholding tax table 2021 federal withholding tax table 2021 calculator federal withholding tax table 2021 semi monthly federal withholding tax table for payroll federal. The employer has a manual payroll system and prefers to use the Wage Bracket Method tables to figure withholding.

Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly. A tax withheld calculator that calculates the correct amount of tax to withhold is also available. P35616 30 over P2192.

446-T 2020 Michigan Income Tax Withholding Tables Keywords. Single or Married Filing Combined - Spouse Works or Married Filing Separate. The requirements to be met by employers with respect to withholding returns and remittances are outlined in the Calendar of Employers Duties on page 38 back page of this booklet.

WEEKLY and the wages are and the number of withholding exemptions claimed is more than but not over the amount of income tax to be withheld shall be --. Effective January 1 2018 to December 31 2022. Tables for Percentage Method of Withholding.

Weekly Tax Table 2021 PDF The full instructions of Federal Income Tax Withholding are provided by the IRS Internal Revenue Service annually. REVISED WITHHOLDING TAX TABLE. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your employer.

The tables and computer formula should be used for all payroll periods ending on or after March 1 2020. 11152019 114414 AM. P660274 35 over P21918.

Tax tables with an asterisk have downloadable look-up tables available in portable document format PDF. For Payroll Paid January December 31 2020. Use the Withholding lookup tool to quickly work out the amount to withhold XLSX 34KB This link will download a file.

Use the charts on pages 19 and 20 to calculate the amount to be withheld for these employees. You should use this table if you make any of the following payments on a weekly basis. Procedures used to calculate federal taxes withheld using the 2019 Form W-4 and prior Form W-4 for 2020 or later on page 4.

The employer determines the wages to be used in the withholding tables by adding to the 300 amount of wages paid the amount of 15870 from Table 1 under Step 145870 total. Therefore there are no changes to Schedule 1 Statement of formulas for calculating amounts to be withheld NAT 1004 nor to the regular tax tables. Additional tax levy.

You find that this amount of 2020 falls in the At least 2000 but less than 2025 range. Our online Weekly tax calculator will automatically work out all your deductions based on your Weekly. IRS Publication 15-T.

If the payroll is WEEKLY. Weekly tax table. For payments made on or after 13 October 2020.

The updates that were made on 13 October 2020 to schedule 1 and the regular tax tables will. Weekly tax table 2 Weekly tax table Amount to be withheld Weekly earnings With taxfree threshold No taxfree threshold 1 2 3 17600 000 3800 17700 000 3800 17800 000 3800 17900 000 3800 18000 000 3900 18100 000 3900 18200 000 3900 18300 000 3900 18400 000 3900 18500 000 4000 18600 000 4000 18700 000 4000. Beginning January 1 2020 the Employers Income Tax Withholding Tax Tables have been adjusted with an effective date of March 1 2020 as a result of Income Tax reductions enacted by the AR General Assembly.

Tax Table Wild Country Fine Arts

Revised Withholding Tax Table Bureau Of Internal Revenue

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

2020 2021 Federal Income Tax Brackets

Federal Withholding Table 2021 Payroll Calendar

Tax Calculator Philippines 2021

Revised Withholding Tax Table On Compensation Grant Thornton

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Revised Withholding Tax Table For Compensation Grant Thornton

Revised Withholding Tax Table Bureau Of Internal Revenue

2021 Bir Train Withholding Tax Calculator Tax Tables

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

How To Compute Your Income Tax In The Philippines

Withholding Tax Computation Under The Train Law Lvs Rich Publishing

Tax Table Wild Country Fine Arts

Train Series Part 4 Amendments To Withholding Tax Regulations Zico

How To Compute Withholding Tax Based On The Newly Enacted Train Law Tax Reform For Acceleration And Inclusion Sprout Solutions

Post a Comment for "Weekly Withholding Tax Table 2020"