Nys Self Employed Unemployment Form

Military Form DD-214 if you were in the military in the last 18 months Next prepare the following information about your self-employment platform or gig work. If you have never filed a claim for benefits in New York State.

New York Ny Dol Unemployment Insurance Compensation Enhanced Pandemic Benefits Pua Peuc And 300 Fpuc Weekly Boost September 2021 Extensions Payment News Status And Updates Aving To Invest

Sign in or create a NYgov ID account and follow the instructions to file a claim.

Nys self employed unemployment form. Documentation required to report self-employment income. Copy of your Schedule C Profit or Loss from Business from your federal income tax return for the tax year noted on your letter. If you are self-employed you may now file for unemployment insurance benefits An additional 600 per week on top of regular benefits to all UI and PUA If you have never filed a claim for benefits in New York State you must create a PIN.

Unemployment Insurance Benefits for Self. They do this on the Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45 which must be filed online see below for information about electronic filing. And all other employment if any.

You can file a claim without all of these documents. Unemployment Insurance Benefits for Self. Your most recent separation form DD 214 for military service.

You can apply to Self-Employment Assistance Program SEAP if you are. Under the new rules claimants can work up to 7 days per week without losing full unemployment benefits for that week if they work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment. Income from self-employment and the means test.

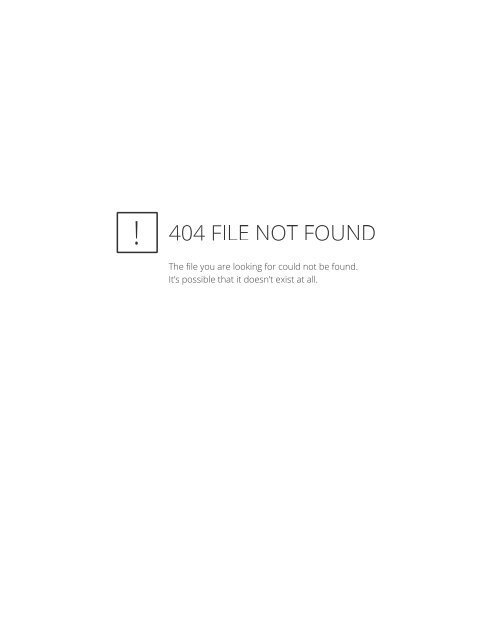

NYS DOLs new partial unemployment system uses an hours-based approach. The ER number is a 7-digit number which can be found on the. For each self-employment or employer that you worked for.

If you cant apply online you can call the TCC at 1-888-209-8124. T he Pandemic Unemployment Assistance PUA provides up to 79 weeks of unemployment benefits to individuals not eligible for regular unemployment compensation or extended benefits including those who have exhausted all rights to such benefits. Income from a job Mark Self employed Complete 3 month business record 2.

Any license registration or. This applies even if the wages are not subject to contributions or withholding under the Personal Income Tax Law. An additional 600 per week in FPUC for the benefit weeks ending 452020 to 7262020 and 300 per week for the benefit weeks ending 132021 to 952021 while you are unemployed.

You do not need to close your business or stop working as self-employed for you to get Jobseekers Allowance and you dont have to be unemployed for at least 4 out of 7 days as for Jobseekers Benefit. If You Are Filing a New UI Claim. What you should do.

Income from a job Do not mark Self employed Mark InconsistentSeasonal 50. Apply online at unemploymentlabornygov. Employer Registration number or Federal Employer Identification Number FEIN of your most recent employer FEIN is on your W-2 forms Your copies of forms SF8 and SF50 if you were a federal employee.

What the Department of Labor came up with a new form that was launched this morning -- where you can fill out one application put in all of the information and the Department of Labor determines if you are not able to get regular unemployment insurance it will automatically put you into pandemic unemployment insurance DeRosa added. At least 18 years of age Eligible to receive at least 13 or more additional weeks of Unemployment Insurance UI benefits The recipient of an invitation letter from the New York State Department of Labor or categorized as a dislocated worker determined via a profile score. Your copy of the W-2 form from the employer Federal Employer Identification FEIN Leave blank If you do not know the FEIN enter your most recent employers New York State Employer Registration Number ER Number.

You must provide all of the following. Summary of How to Enter Self-Employment Income 1. You will get Jobseekers Allowance if your income is below a certain level.

Https Maketheroadny Org Wp Content Uploads 2020 05 Eng Step By Step Ui Kyr Pdf Download Unemployment Insurance And Covid 19

New York State Department Of Labor Posts Facebook

Nys Department Of Labor On Twitter If You Are Self Employed You Can Now Apply For Unemployment Insurance Benefits The Best Way To File Is Online At Https T Co T2tezsp2lf Please See Guidance Below On

Https Dol Ny Gov How Get Your 1099 G Online

Cover Letters Cover Letter For Online Application Business Development Cover Letter Online Application Alway Job Cover Letter Cover Letter For Resume Lettering

Unemployment Insurance Benefits For Self Employed Contractors And Farmers Department Of Labor

Https Dol Ny Gov Employers Guide Unemployment Insurance Benefits Ia 3182

Https Dol Ny Gov New York State Employer Registration Form Unemployment Insurance And Withholding And Wage Reporting

Https Dol Ny Gov How Get Your 1099 G Online

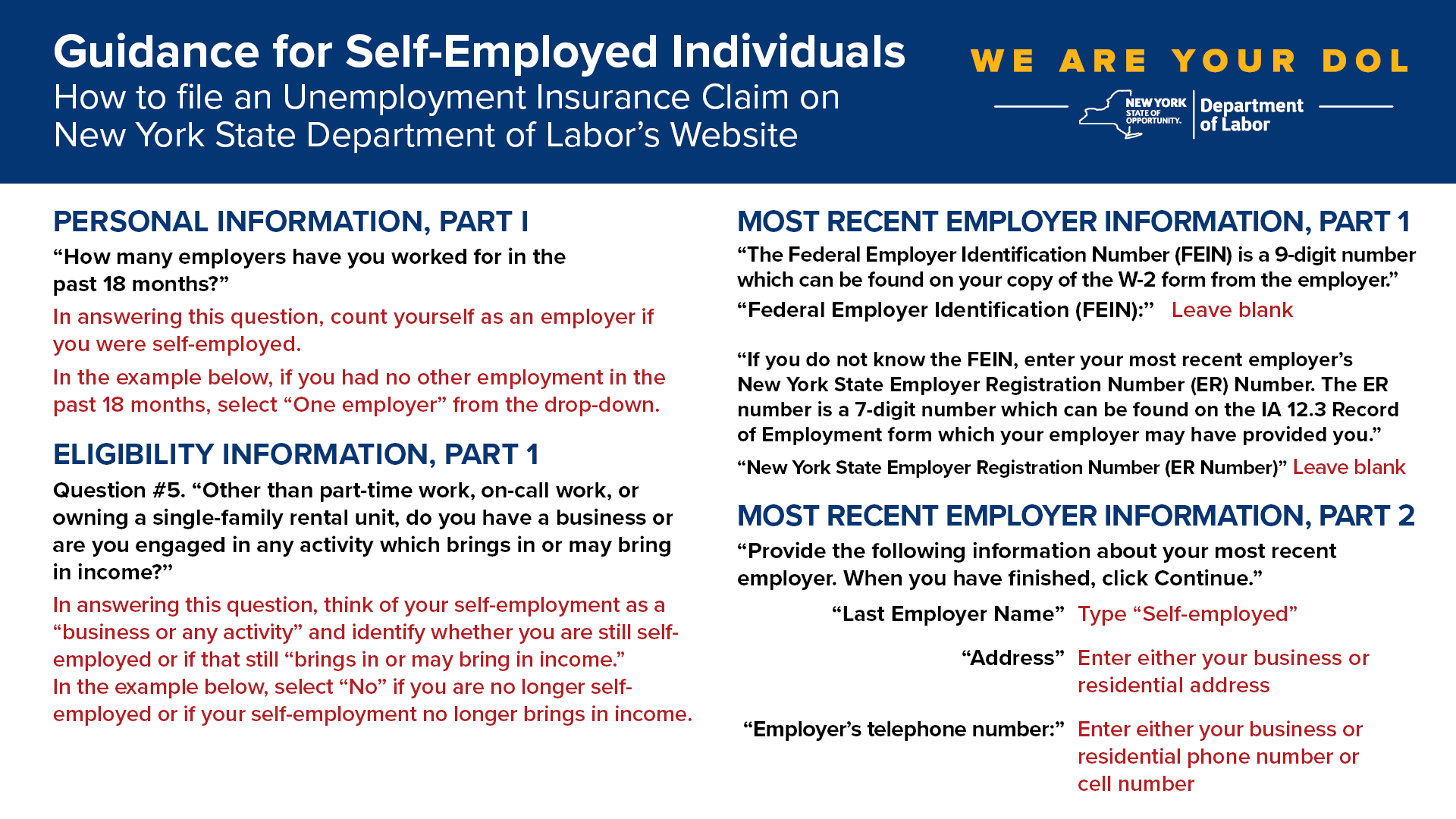

Free New York Name Change Forms How To Change Your Name In Ny Pdf Eforms

Https Coronavirus Health Ny Gov Unemployment Insurance Guidance Self Employed Individuals

Ny Preparing The Nys 45 Upload File Cwu

Nys Department Of Labor On Twitter While Fpuc Benefits Have Expired Ui And Pua Benefits Have Been Extended For New Yorkers When Your Effective Days Remaining Reaches 0 During Your Benefit Year

Https Dol Ny Gov How Get Your 1099 G Online

Https Coronavirus Health Ny Gov Unemployment Insurance Guidance Self Employed Individuals

Form It 201 Resident Income Tax Return The New York State

Ny Preparing The Nys 45 Upload File Cwu

How To File A Claim For Unemployment Insurance In Ny Uber Or Lyft Driver Or Any Self Employed Youtube

Pandemic Unemployment New York State Department Of Labor Facebook

Post a Comment for "Nys Self Employed Unemployment Form"