How To Determine Unemployment Eligibility

To be eligible for Unemployment Insurance UI benefits you must. If you file your unemployment claim in January through March your base period is January through September of the previous year as well as October through December of the year prior to that.

Make at least 2250at least 1500 during one of the calendar quarters and at least 750 during the remainder of the base periodfrom an insured employer during your base period.

How to determine unemployment eligibility. You are not required to search for work for weeks of unemployment that began before July 11. No-fault circumstance that leads to the termination of employment such as a layoff or discharge. Acceptable reason of separation.

We need to know why youre out of work and whether your recent earnings meet the minimum required by law. Unemployment compensation UC is money paid to workers who have lost their jobs through no fault of their own. It typically means you are ineligible if you quitalthough there are exceptions like if you quit because of impossible work conditions.

However according to the US. Department of Labor there are two main criteria that must be met in order to qualify. Work Search Starting July 11 2021 most people will be expected to search for work to maintain their eligibility for unemployment benefits.

While it varies based on your state you generally need two things to qualify. As of October 4 2020 the maximum weekly benefit amount is 855 per week. Any unemployed person may file a claim for UC benefits.

Lose your job through no fault of your own OR quit for good cause related to the work or the employer. When you first apply for Unemployment Insurance benefits we look at a few different factors to see if you qualify. 5400 during the last 4 completed calendar quarters and.

If a disability has caused you to be unable to work or unable to work in the capacity you were once able to you may be eligible for Massachusetts disability benefitsTo determine eligibility use the information presented in the Determining Disability Eligibility section. Have earned at least. Be legally authorized to work in the US.

You should always file your unemployment benefits claim in the state where you worked. Eligibility requirements to qualify for unemployment compensation vary from state to state. This can be determined at the time of filing.

We use the taxable wages earned in Texas your employer s have reported paying you during your base period to calculate your benefits. Once you file your claim the EDD will verify your eligibility and wage information to determine your weekly benefit amount WBA. 26 times the weekly benefit amount you would be eligible to collect.

You must have earned enough money in the past 18 months for Illinois to establish a weekly benefit amount. You may also have social security eligibility. The Unemployment Insurance UI benefit calculator will provide you with an estimate of your weekly UI benefit amount which can range from 40 to 450 per week.

Past Wages Your past wages are one of the eligibility requirements and the basis of your potential unemployment benefit amounts. Claims can generally be filed online although there are some instances where claims can be filed over the telephone or by mail. Report the 25000 the total amount of your unemployment compensation on line 7 and report 15200 on line 8 as a negative amount in parentheses.

Your eligibility is based on the information provided by you and your employer s after you file an application for UC benefits. To be eligible for unemployment benefit payments you must. First you need to have lost your job through no fault of your own.

To file your claim contact your state unemployment insurance agency. List your total wages in the last 4 quarters in which you worked. First make sure you are eligible for unemployment.

The best way to determine your Massachusetts unemployment benefits eligibility is to apply but the following lists may help you understand if you could qualify under Massachusetts law. You must be unemployed through no fault of your own. After you first qualify for benefits you will need to meet some additional requirements in order to keep receiving them.

To qualify for Massachusetts unemployment you must need to meet the criteria for work and wages eligibility. The 15200 excluded from income is all of the 5000 unemployment compensation paid to your spouse plus 10200 of the 20000 paid to you. In most cases your unemployment agency will look at a base period of these four full calendar quarters when determining eligibility.

Follow the steps below to calculate the amount of unemployment benefits you may be eligible to receive each week.

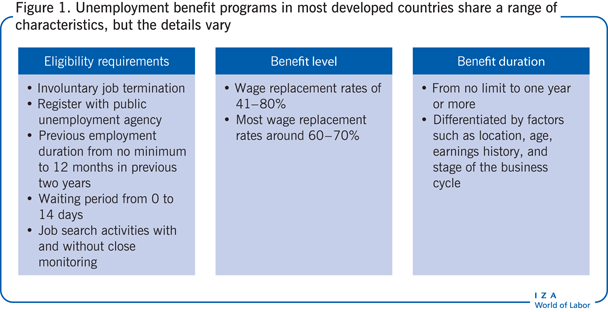

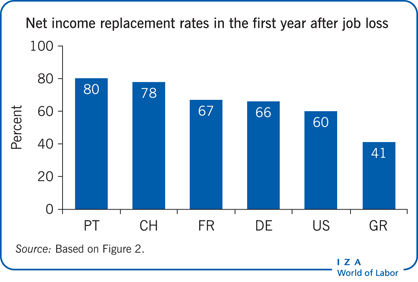

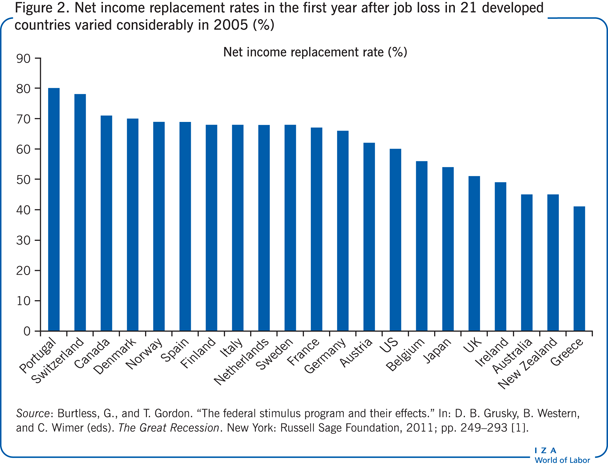

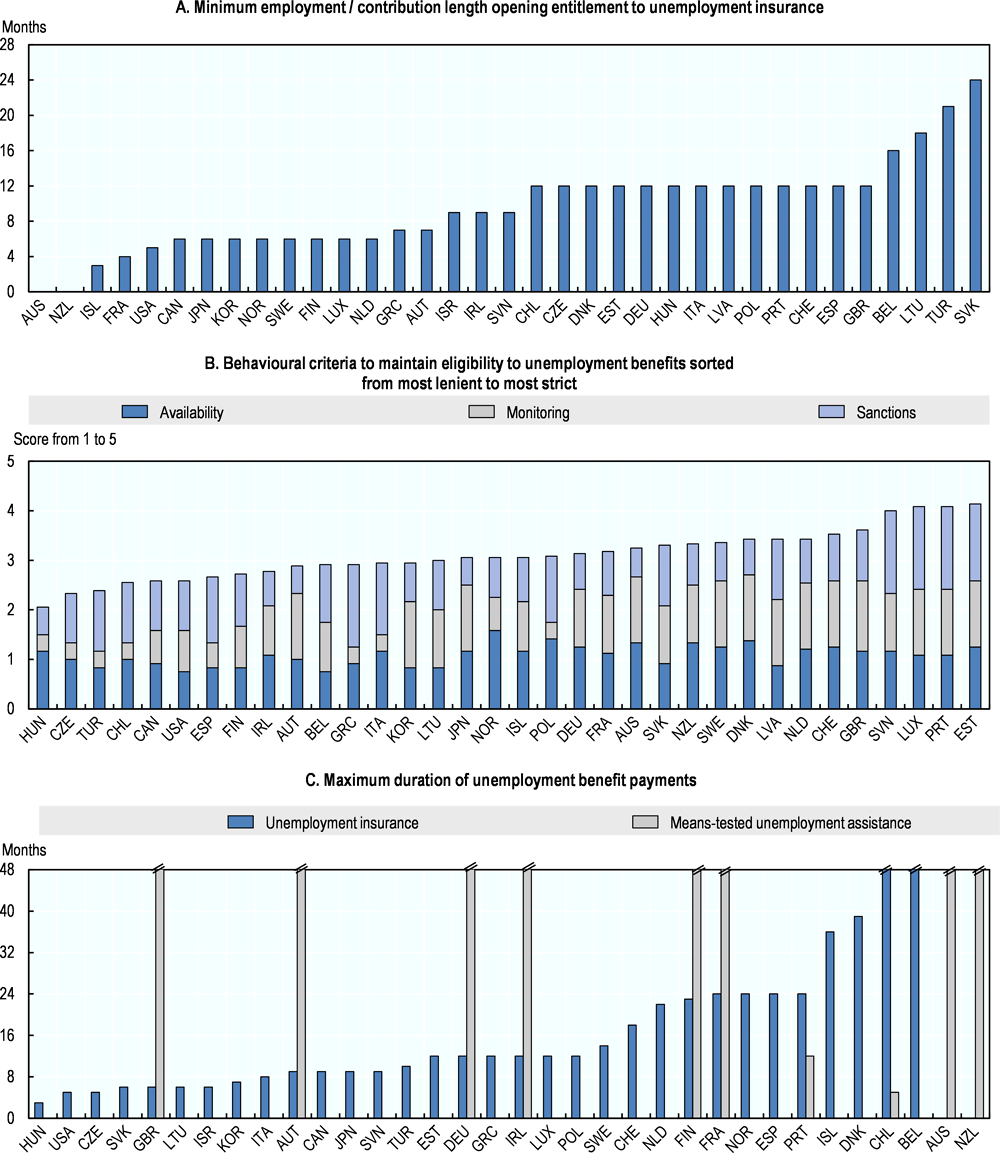

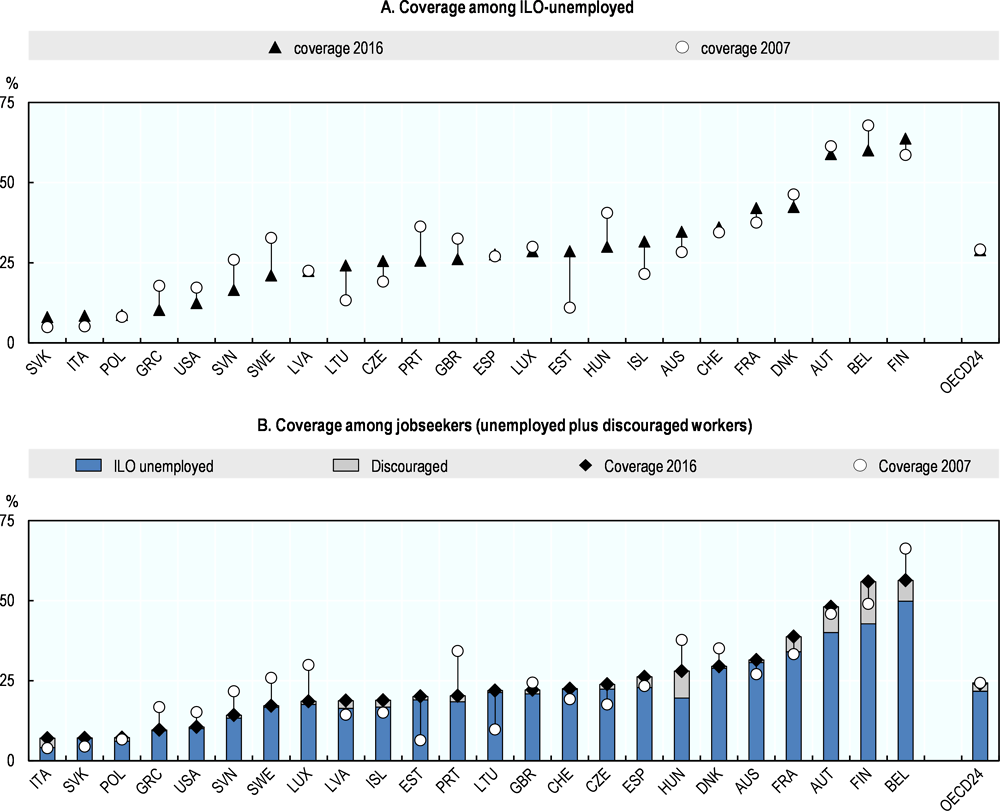

Iza World Of Labor Unemployment Benefits And Unemployment

Unemployment Benefit In The Netherlands Dutch Allowances

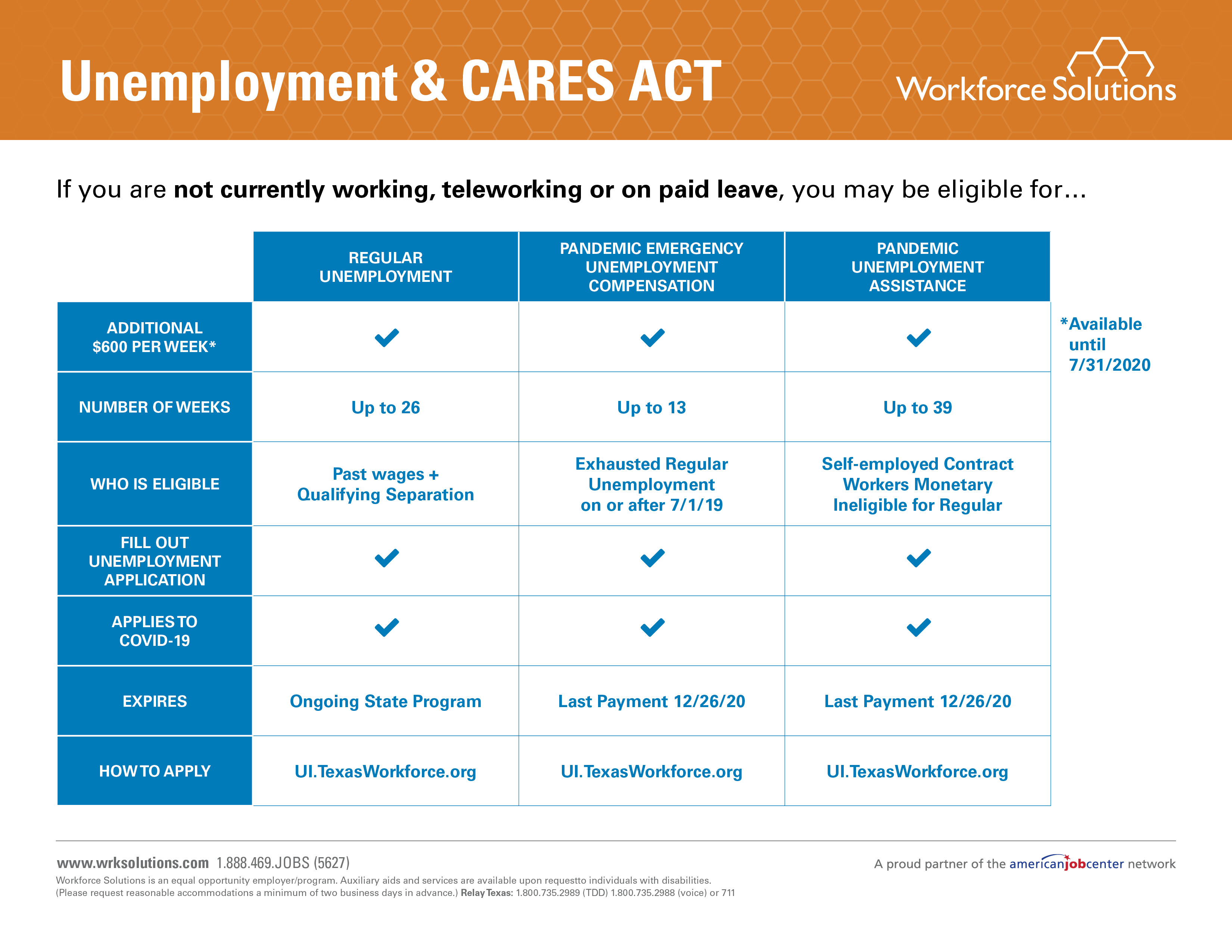

Des Covid 19 Information For Individuals

Unemployment Benefits Comparison By State Fileunemployment Org

Esdwagov Calculate Your Benefit

Unemployment Benefits For The Jobless

Https Ec Europa Eu Info Sites Info Files File Import European Semester Thematic Factsheet Unemployment Benefits En 0 Pdf

Iza World Of Labor Unemployment Benefits And Unemployment

Unemployment Benefits In The Netherlands I Amsterdam

Iza World Of Labor Unemployment Benefits And Unemployment

Unemployment Appeal Letter Sample Proposal Sample For Proof Of Unemployment Letter Template In 2021 Letter Template Word Letter Templates Letter Sample

Post a Comment for "How To Determine Unemployment Eligibility"